The Blessings of a Bear Market

Wednesday, May 19th was a great day at Multis. Why? Well, we onboarded some amazing teams for our crypto business account. It was great hearing their feedback and watching ops and finance professionals discover an app that is already helping them get a better overview of their finances and secure their treasury. We're so excited to co-create this product with some of the most innovative companies around.

Maybe you weren't expecting me to say that, because the words crypto twitter were throwing around were "bloodbath", "black Wednesday" and "shit show". And I won't deny that it's never fun watching your crypto lose value in a matter of minutes (and don't get me started on the gas fees).

Nobody loves a bear market. The same friends who a few months back were texting me for advice on tokens and yield farming techniques are now sending their condolences as though a family member died.

But here's the thing, at Multis it wasn't the end of the world. We've seen this before (hello, 2017!) and throughout 2020's "Summer of DeFi" and this winter's Bitcoin Boom we knew that the party would end at some point. We even think that this "bear season" (however long it's going to last) is a welcome relief from the growing frenzy, we also think this will make us a better company. Here's why:

We can take advantage of low gas fees

These past few months had a frenetic energy in the crypto space. While it was amazing to watch the rapid mainstreaming of digital assets, our engineers were often held hostage by high gas fees. We have an ambitious product roadmap and there were days where building was hard to do. Ever since May 20th, we've been making the most of the post-crash low network fees to build without the added distraction. This means we're doubling down on building a great UX, bridging fiat and crypto, and going deeper on the Layer 2 scaling solutions that we've been following. As many of you know, we hope to test a few promising solutions that are best adapted to our user's needs.

The crash is a stress test

Just as the 2000s dot-com bubble wiped out Pets.com but spared companies like eBay and Amazon, I think this current downturn will have similar effects on the glut of crypto businesses that were hastily formed this past year. As Fred Ersham at Paradigm says, businesses built on "poor fundamentals and flawed strategies are ruthlessly exposed in down cycles. Many fail to survive. Those who do have the tremendous advantage of having built while others perished" and have greater chances of thriving during the next uptick.

I don't like being glib about businesses going bust: this has real consequences on people's lives. However, I do think that the businesses that survive this current downturn will be even stronger- in the same way that the businesses who survived 2017 have grown enormously. Our design partners are companies with solid business models and a clear company vision. The work that we're doing with them hasn't changed- if anything it's gotten easier because lots of the noise in the industry has quieted down.

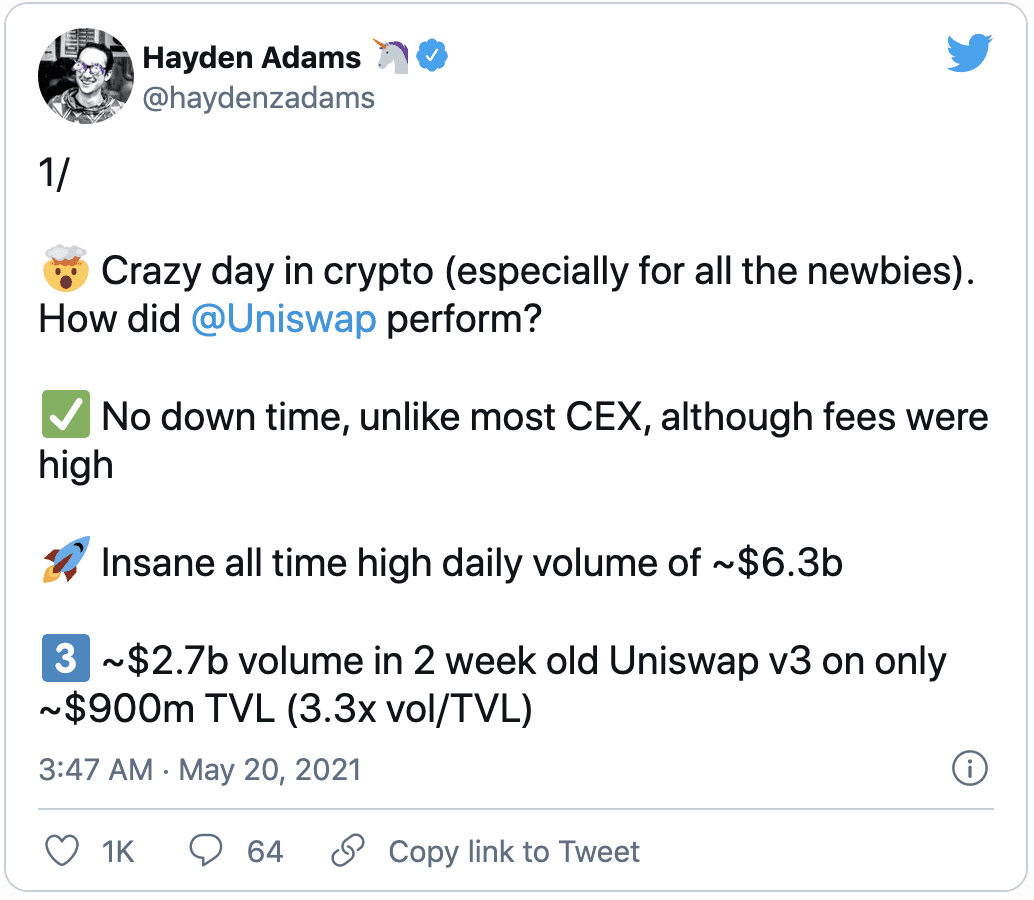

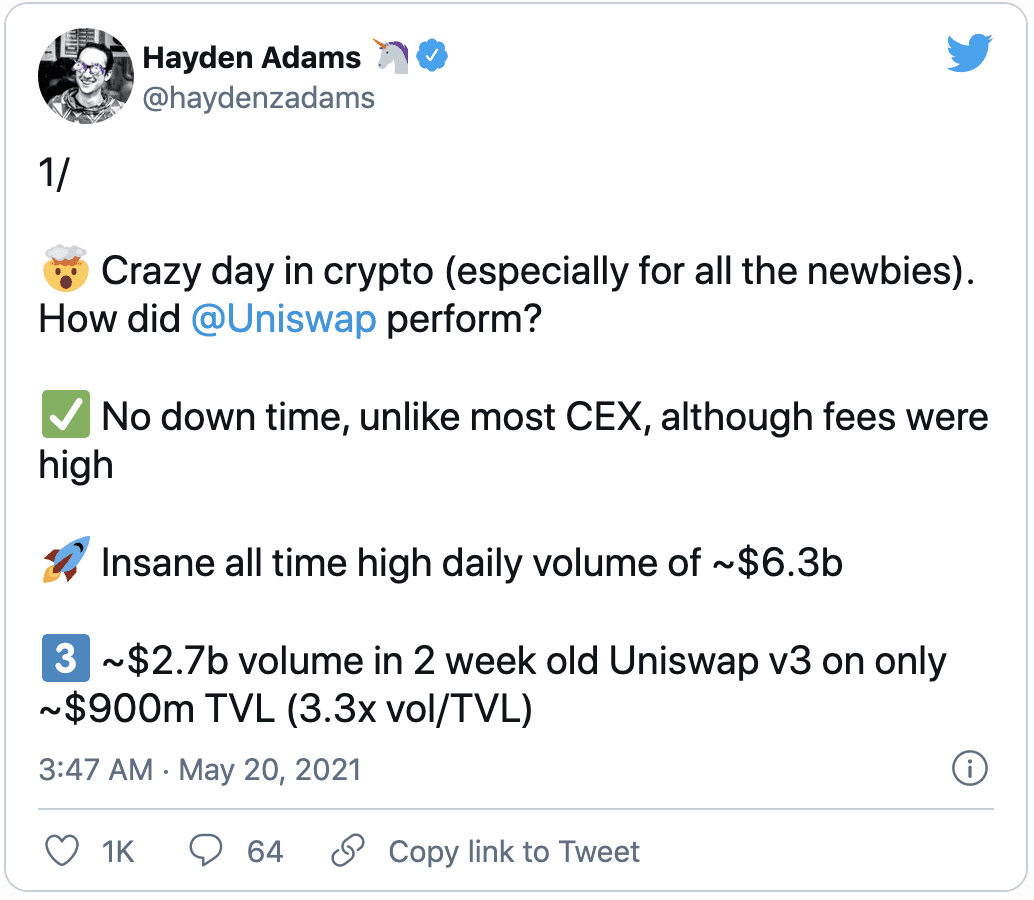

I was particularly inspired by statements made by the founders at Uniswap and Compound: two wildly successful DeFi protocols who are unfazed by the downturn and are continuing building and improving their product.

The way we see it: this is a marathon and not a sprint. Right now, is the perfect time to keep our heads down and work. Frankly we don't mind the quiet.

Time out of the spotlight

While the 2020-2021 crypto bull run had lots of positives in terms of mainstreaming digital assets, the exuberant atmosphere has lead to greater regulatory attention- veering on overreaction. Indeed, with thousands of new investors in the space there was room for scams, losses and rekts. At Multis, we're here to build and extra regulatory focus can add frictions. I spent a good portion of my time in this bull run lobbying instead of talking to users.

We don't really care!

We have a company policy of not following prices. Why? Because we think that teams can get distracted following valuations - especially in times of volatility.

At Multis we're not in crypto because we think we can get rich quick, we're in crypto because we think that digital assets and blockchain technology will revolutionize our financial system. If you follow valuation too closely, you'll run the risk of getting distracted by the euphoria of a high price and then the following despair when the price drops.

We're much more likely to get excited about a labelling function on our Multis accounts than we are about some tech CEO tweeting about meme tokens or the price of Ethereum dropping. We know that there will be another summer of DeFi and that Multis will be a part of it- we're here for the long term and are aware that crypto markets are volatile.

At Multis, we made the most of the boom: we fundraised throughout the summer of DeFi , doubled our team (and we're still hiring!), and got the word out about our vision and our product. We feel lucky to have the ressources and the staff to keep our heads down and build. Right now, the priority is offering dollar and euro accounts to give true holistic support to companies who use crypto. We think crypto is here to stay and so we're staying at the office, building a best financial OS for companies with crypto. I'd like to conclude with wise words of Robert Leshner, visionary and CEO of Compound.

Couldn't have said it better myself!

Wednesday, May 19th was a great day at Multis. Why? Well, we onboarded some amazing teams for our crypto business account. It was great hearing their feedback and watching ops and finance professionals discover an app that is already helping them get a better overview of their finances and secure their treasury. We're so excited to co-create this product with some of the most innovative companies around.

Maybe you weren't expecting me to say that, because the words crypto twitter were throwing around were "bloodbath", "black Wednesday" and "shit show". And I won't deny that it's never fun watching your crypto lose value in a matter of minutes (and don't get me started on the gas fees).

Nobody loves a bear market. The same friends who a few months back were texting me for advice on tokens and yield farming techniques are now sending their condolences as though a family member died.

But here's the thing, at Multis it wasn't the end of the world. We've seen this before (hello, 2017!) and throughout 2020's "Summer of DeFi" and this winter's Bitcoin Boom we knew that the party would end at some point. We even think that this "bear season" (however long it's going to last) is a welcome relief from the growing frenzy, we also think this will make us a better company. Here's why:

We can take advantage of low gas fees

These past few months had a frenetic energy in the crypto space. While it was amazing to watch the rapid mainstreaming of digital assets, our engineers were often held hostage by high gas fees. We have an ambitious product roadmap and there were days where building was hard to do. Ever since May 20th, we've been making the most of the post-crash low network fees to build without the added distraction. This means we're doubling down on building a great UX, bridging fiat and crypto, and going deeper on the Layer 2 scaling solutions that we've been following. As many of you know, we hope to test a few promising solutions that are best adapted to our user's needs.

The crash is a stress test

Just as the 2000s dot-com bubble wiped out Pets.com but spared companies like eBay and Amazon, I think this current downturn will have similar effects on the glut of crypto businesses that were hastily formed this past year. As Fred Ersham at Paradigm says, businesses built on "poor fundamentals and flawed strategies are ruthlessly exposed in down cycles. Many fail to survive. Those who do have the tremendous advantage of having built while others perished" and have greater chances of thriving during the next uptick.

I don't like being glib about businesses going bust: this has real consequences on people's lives. However, I do think that the businesses that survive this current downturn will be even stronger- in the same way that the businesses who survived 2017 have grown enormously. Our design partners are companies with solid business models and a clear company vision. The work that we're doing with them hasn't changed- if anything it's gotten easier because lots of the noise in the industry has quieted down.

I was particularly inspired by statements made by the founders at Uniswap and Compound: two wildly successful DeFi protocols who are unfazed by the downturn and are continuing building and improving their product.

The way we see it: this is a marathon and not a sprint. Right now, is the perfect time to keep our heads down and work. Frankly we don't mind the quiet.

Time out of the spotlight

While the 2020-2021 crypto bull run had lots of positives in terms of mainstreaming digital assets, the exuberant atmosphere has lead to greater regulatory attention- veering on overreaction. Indeed, with thousands of new investors in the space there was room for scams, losses and rekts. At Multis, we're here to build and extra regulatory focus can add frictions. I spent a good portion of my time in this bull run lobbying instead of talking to users.

We don't really care!

We have a company policy of not following prices. Why? Because we think that teams can get distracted following valuations - especially in times of volatility.

At Multis we're not in crypto because we think we can get rich quick, we're in crypto because we think that digital assets and blockchain technology will revolutionize our financial system. If you follow valuation too closely, you'll run the risk of getting distracted by the euphoria of a high price and then the following despair when the price drops.

We're much more likely to get excited about a labelling function on our Multis accounts than we are about some tech CEO tweeting about meme tokens or the price of Ethereum dropping. We know that there will be another summer of DeFi and that Multis will be a part of it- we're here for the long term and are aware that crypto markets are volatile.

At Multis, we made the most of the boom: we fundraised throughout the summer of DeFi , doubled our team (and we're still hiring!), and got the word out about our vision and our product. We feel lucky to have the ressources and the staff to keep our heads down and build. Right now, the priority is offering dollar and euro accounts to give true holistic support to companies who use crypto. We think crypto is here to stay and so we're staying at the office, building a best financial OS for companies with crypto. I'd like to conclude with wise words of Robert Leshner, visionary and CEO of Compound.

Couldn't have said it better myself!