Nail Your DAO: Level Up Your Bookkeeping experience

Moving on with our DAO Ops series, it's time to bring up bookkeeping and some best practices that will keep your books clean and your accounts balanced.

Next, we will be covering:

-Hiring in DAOs

-Team Structure in DAOs

-KPIs for DAOs

You can also check previous topics:

Bookkeeping is the process of tracking and recording your business’s financial transactions. It is applicable to all every operational entity, and web3 organizations are not exempt.

Why is it important to maintain clean books from day 1?

Get Clarity & Control with your closed books: Having closed books means having access to updated financial reports such as balance sheets, P&L statements, and cash flow statements, which you can analyze to grow your business and make strategic decisions. It also means better budgeting and cash flow projections, because you are aware of your accounts payables and accounts receivable. In the crypto world where volatility is inevitable, this also means consolidated data and transactions converted in Fiat which is vital for the valuation of your assets.

Transparency & Trust through Reporting: Having clean books ready at any time, is a great advantage because you will always feel ready to share financial information like spending breakdowns with your community — which is a great away to earn their trust. If you have investors or are looking for investors, you will require regular financial reports to prove that you are on the right track.

Tax compliance: Being tax compliant requires having closed books. This is not something you want to do last minute when you are in the crypto space because reconciling old transactions gets more complex with time. Although, taxation is still in the grey, start with the basics like figuring out what is your taxable income, which expenses fall into operating expenses, and what are your tax benefits, and discuss this with your contributors to maintain transparency. You can even help them out by sending a 1099 template.

Tips to streamline your DAO bookkeeping process

Discipline is key: This is actually a matter of discipline. These basic steps will you save a lot of time if you successfully adopt them in your routine:

As soon as transactions occur, note the following information: the date of the transaction, (purchase and sales), the price of the token or NFT purchased, the capital gain, transaction fees, and exchange fees

Make sure you are using the right method for accounting (FIFO or LIFO).

You can start noting this information on a spreadsheet customized to your needs.

Get a crypto-friendly accountant: Unfortunately, with crypto, you can’t just give your Etherscan data to a bookkeeper and have them work their magic. When finding one that’s right for you, you should ask some basic questions to assess their knowledge. We also recommend that you use a tax tool like Cointracker.

💡 Reach out to valens@multis.co and we will happily share with you a list of accountants that we trust. 😉

Level up with tools like Multis: Multis aims to help web3 organizations automate their finops, so they can focus on building. We built a bookkeeping-friendly tool to help finance managers stay on top of their game, thanks to the following features:

Categorize your transactions: each transaction on Multis has a tick-box to the left. Users can select as many transactions as needed (or select all), then click on + category/note on the right-hand side. They can then add a category label and/or a note to every selected transaction. This should save time and make accounting less manual.

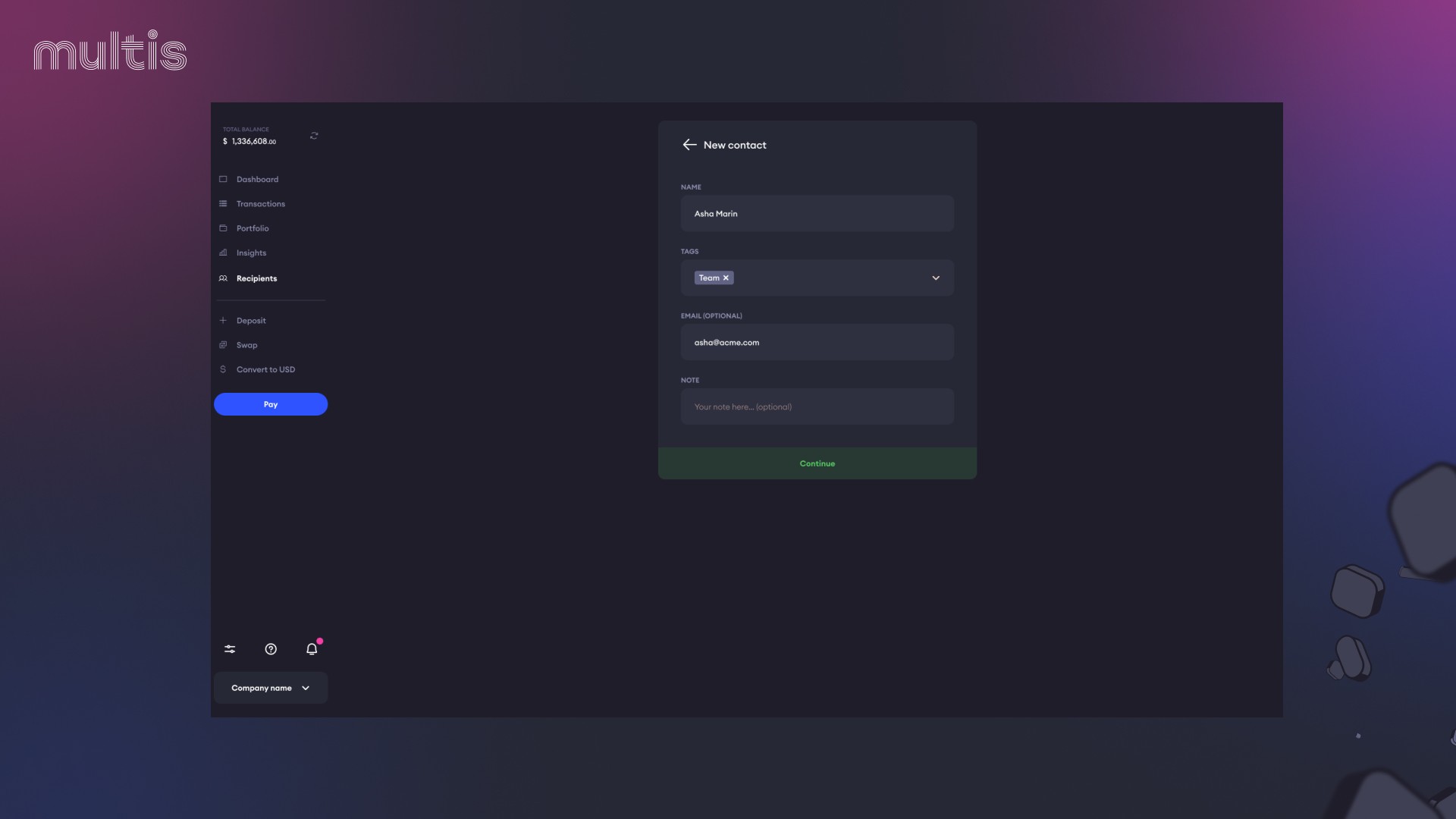

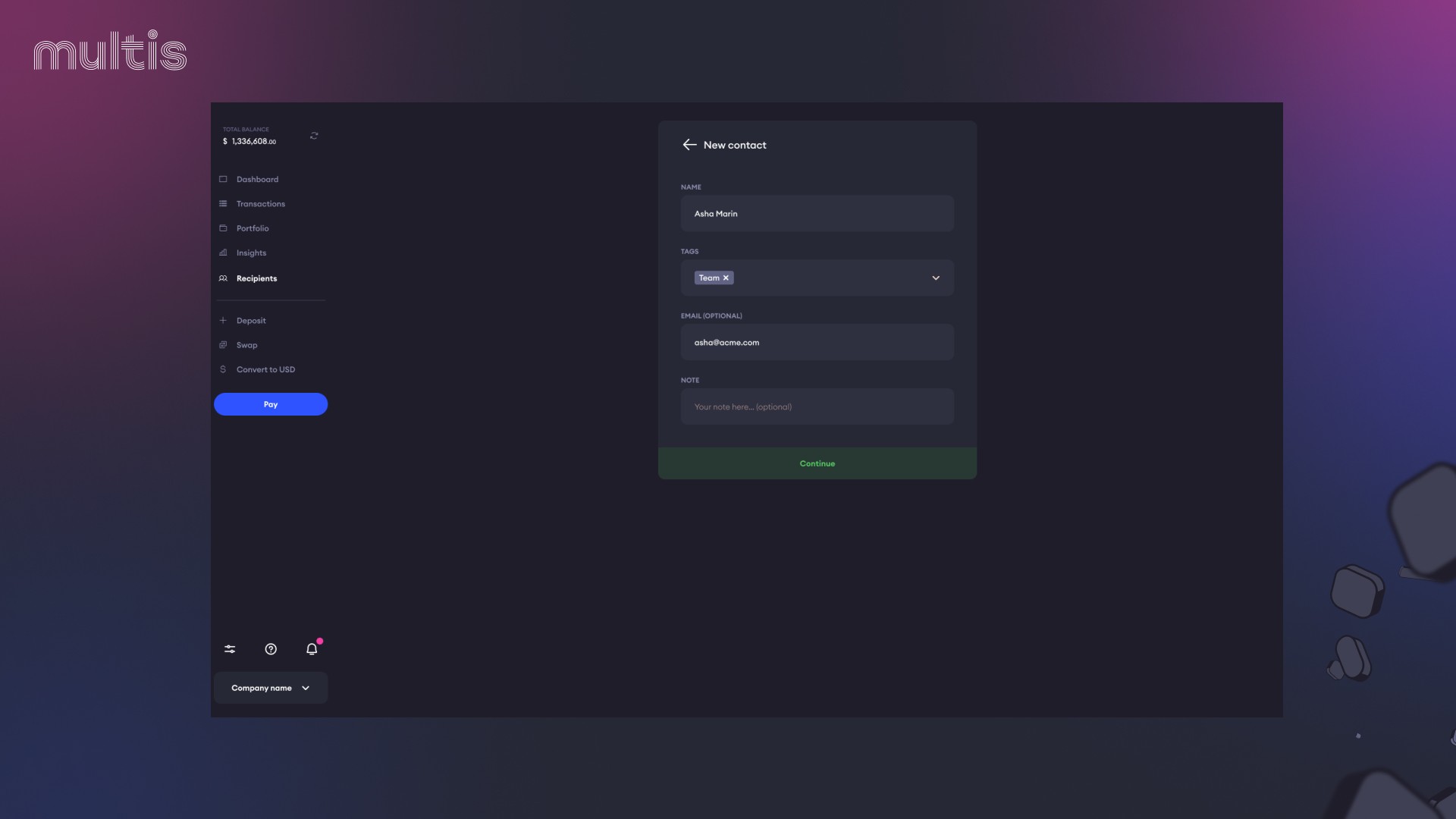

Add your teammates to your address book: Save time and avoid copy-paste errors when making payments by adding your teammates and the people you pay regularly to your contact book. This will also make it easier for you to make mass payments and perform crypto payroll!

Export Quickbooks ready CSV: Multis users can export their transaction data as either a standard CSV document or a CSV that's formatted to QuickBook's specifications. This is designed to save users time when they're reconciling their transactions data.

Curious to know what other features Multis offers to revolutionize your FinOps stack? Book a demo with us!

Moving on with our DAO Ops series, it's time to bring up bookkeeping and some best practices that will keep your books clean and your accounts balanced.

Next, we will be covering:

-Hiring in DAOs

-Team Structure in DAOs

-KPIs for DAOs

You can also check previous topics:

Bookkeeping is the process of tracking and recording your business’s financial transactions. It is applicable to all every operational entity, and web3 organizations are not exempt.

Why is it important to maintain clean books from day 1?

Get Clarity & Control with your closed books: Having closed books means having access to updated financial reports such as balance sheets, P&L statements, and cash flow statements, which you can analyze to grow your business and make strategic decisions. It also means better budgeting and cash flow projections, because you are aware of your accounts payables and accounts receivable. In the crypto world where volatility is inevitable, this also means consolidated data and transactions converted in Fiat which is vital for the valuation of your assets.

Transparency & Trust through Reporting: Having clean books ready at any time, is a great advantage because you will always feel ready to share financial information like spending breakdowns with your community — which is a great away to earn their trust. If you have investors or are looking for investors, you will require regular financial reports to prove that you are on the right track.

Tax compliance: Being tax compliant requires having closed books. This is not something you want to do last minute when you are in the crypto space because reconciling old transactions gets more complex with time. Although, taxation is still in the grey, start with the basics like figuring out what is your taxable income, which expenses fall into operating expenses, and what are your tax benefits, and discuss this with your contributors to maintain transparency. You can even help them out by sending a 1099 template.

Tips to streamline your DAO bookkeeping process

Discipline is key: This is actually a matter of discipline. These basic steps will you save a lot of time if you successfully adopt them in your routine:

As soon as transactions occur, note the following information: the date of the transaction, (purchase and sales), the price of the token or NFT purchased, the capital gain, transaction fees, and exchange fees

Make sure you are using the right method for accounting (FIFO or LIFO).

You can start noting this information on a spreadsheet customized to your needs.

Get a crypto-friendly accountant: Unfortunately, with crypto, you can’t just give your Etherscan data to a bookkeeper and have them work their magic. When finding one that’s right for you, you should ask some basic questions to assess their knowledge. We also recommend that you use a tax tool like Cointracker.

💡 Reach out to valens@multis.co and we will happily share with you a list of accountants that we trust. 😉

Level up with tools like Multis: Multis aims to help web3 organizations automate their finops, so they can focus on building. We built a bookkeeping-friendly tool to help finance managers stay on top of their game, thanks to the following features:

Categorize your transactions: each transaction on Multis has a tick-box to the left. Users can select as many transactions as needed (or select all), then click on + category/note on the right-hand side. They can then add a category label and/or a note to every selected transaction. This should save time and make accounting less manual.

Add your teammates to your address book: Save time and avoid copy-paste errors when making payments by adding your teammates and the people you pay regularly to your contact book. This will also make it easier for you to make mass payments and perform crypto payroll!

Export Quickbooks ready CSV: Multis users can export their transaction data as either a standard CSV document or a CSV that's formatted to QuickBook's specifications. This is designed to save users time when they're reconciling their transactions data.

Curious to know what other features Multis offers to revolutionize your FinOps stack? Book a demo with us!