Crypto Accounting: How Multis makes things easier

At Multis, we believe that Decentralized Finance provides tools that can empower a new generation of entrepreneurs. This is why we are so passionate about what we do: creating the perfect crypto wallet for businesses where entrepreneurs can have access to the most relevant DeFi services is what gets us up in the morning. Providing high interest savings accounts, automated trading, token swaps, and invoicing are among some of our key product features, but we are also aware that crypto accounting is necessary for any company running operations in crypto.

Let’s be honest: right now, in 2020 running a business on crypto is an accounting hell. Nobody gets excited talking about crypto accounting but good bookkeeping is essential for the health of any business no matter how small.

Crypto accounting: because crypto doesn’t speak bookkeeping

One of our motivations in designing our Multis accounts was to format blockchain transactional data into an easy-to-understand banking framework. Thibaut, our CEO could speak from experience: “During the early days at Multis, when we were working hard at building our interface, I could easily spend a full 10-hour day doing basic crypto accounting: tracking our transactions, identifying them, and consolidating them” before even showing the data to the company accountant! Blockchain data is unreadable to the average company accountant, and accounting for using the network is a necessary step that can take hours to do by hand. But as time consuming and tedious as this all was, it gave our team valuable insights into how we could design accounts that made transacting in crypto as easy to account for as transacting in traditional currencies.

Multis fee-less accounts streamline crypto accounting

Ethereum network fees (aka “gas fees”) have to be paid with every transaction on the Ethereum blockchain, and even if these fees are a few cents any company that is on the Ethereum blockchain has to account for these fees when they’re doing their bookkeeping.

“Entering network fees into a bookkeeping format was a nightmare, “ Thibaut explained, “I could easily spend 2 hours on this alone. We were advancing network fees from other internal wallets, and I had to go to etherscan to extract and identify counterparties for every transaction processed. Some counterparties were users, others were smart contracts- they all had long pseudonymous ETH addresses. I would then have to add these addresses to an excel spreadsheet alongside our other company transactions.”

This pain point was one of our motivations behind launching our GSN fee-less accounts where network fees are covered by Multis. Because Multis is a banking app, our job is to remove all non-financial data. The fee-less accounts allow our users to report their business transactions,not internal transactions that cover network fees.

Multisignature access controls save your accountant time

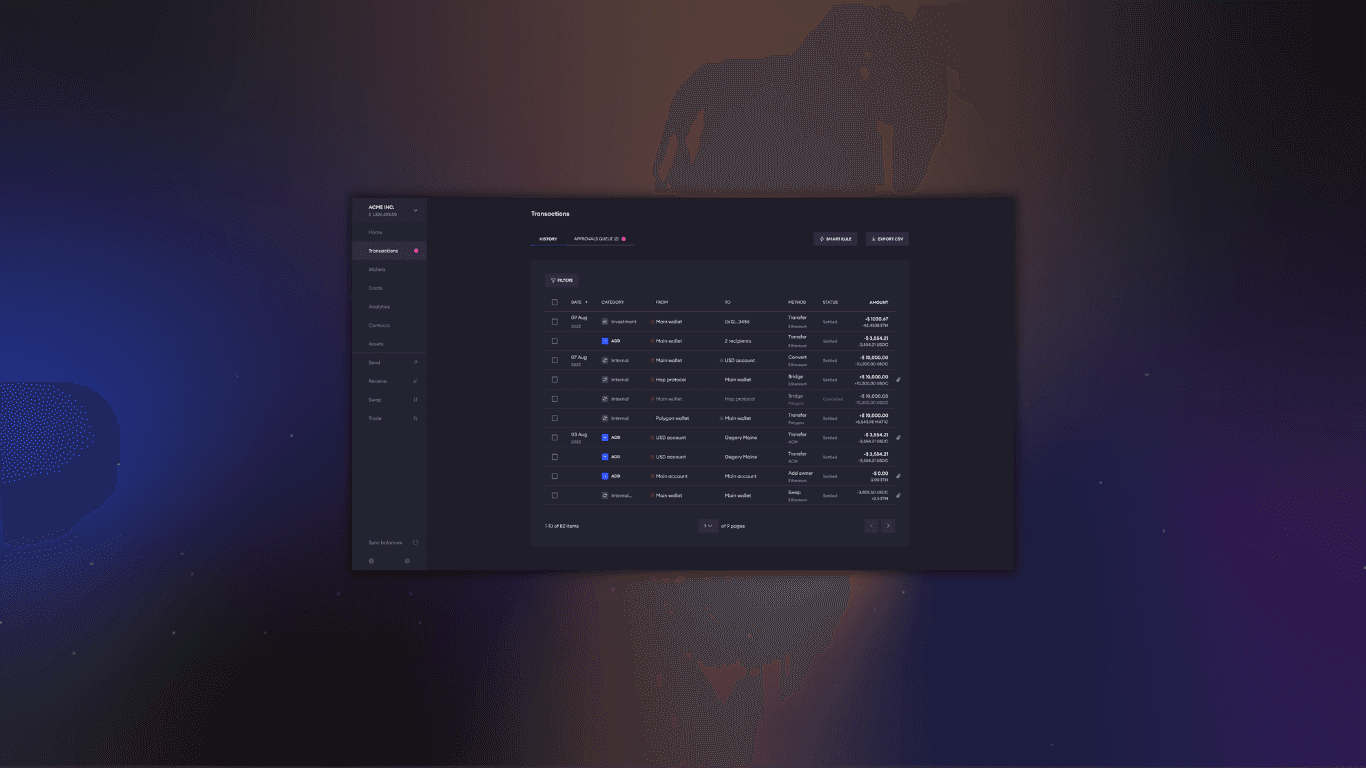

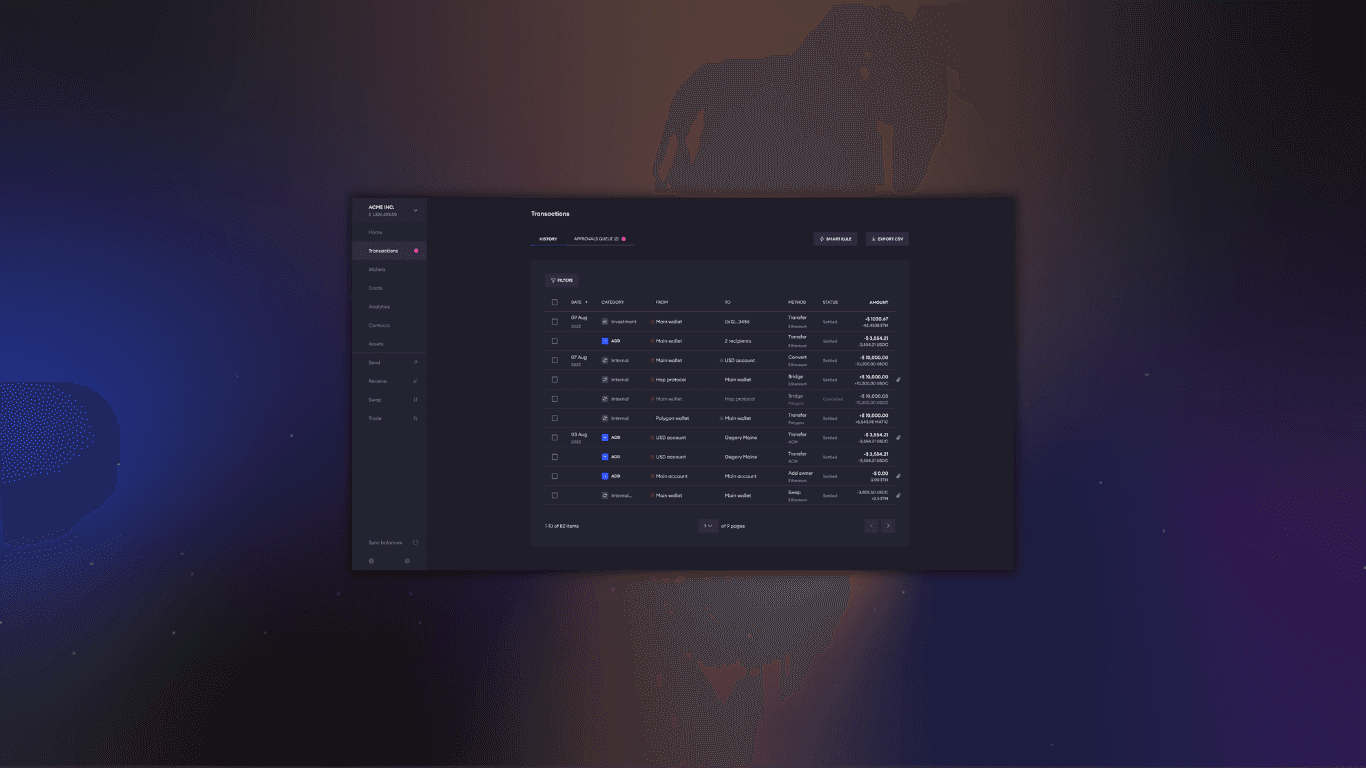

One of the advantages of our multisignature wallet is that owners can invite users by email, and give them reading rights only. This means your company accountant can login to your account, consult funds, and even download a .csv file of your company’s transaction historywithout the fear that she will make any transactions herself. This makes your company workflow smoother and saves time in transferring data to excel files.

Tags, .csv exports, and an address book: making data compatible with crypto accounting software

Although we’re not (yet!) integrated with an accounting software, Multis has features that are crypto accounting friendly including a tag function that allows users to label expenses by type (IT, payroll, client services, etc.); a built-in address book allowing users to save the names and descriptions of frequent counterparties; and finally all transactional data can be exported to .csv format for an easier integration with traditional or crypto bookkeeping software.

At Multis, we believe that Decentralized Finance provides tools that can empower a new generation of entrepreneurs. This is why we are so passionate about what we do: creating the perfect crypto wallet for businesses where entrepreneurs can have access to the most relevant DeFi services is what gets us up in the morning. Providing high interest savings accounts, automated trading, token swaps, and invoicing are among some of our key product features, but we are also aware that crypto accounting is necessary for any company running operations in crypto.

Let’s be honest: right now, in 2020 running a business on crypto is an accounting hell. Nobody gets excited talking about crypto accounting but good bookkeeping is essential for the health of any business no matter how small.

Crypto accounting: because crypto doesn’t speak bookkeeping

One of our motivations in designing our Multis accounts was to format blockchain transactional data into an easy-to-understand banking framework. Thibaut, our CEO could speak from experience: “During the early days at Multis, when we were working hard at building our interface, I could easily spend a full 10-hour day doing basic crypto accounting: tracking our transactions, identifying them, and consolidating them” before even showing the data to the company accountant! Blockchain data is unreadable to the average company accountant, and accounting for using the network is a necessary step that can take hours to do by hand. But as time consuming and tedious as this all was, it gave our team valuable insights into how we could design accounts that made transacting in crypto as easy to account for as transacting in traditional currencies.

Multis fee-less accounts streamline crypto accounting

Ethereum network fees (aka “gas fees”) have to be paid with every transaction on the Ethereum blockchain, and even if these fees are a few cents any company that is on the Ethereum blockchain has to account for these fees when they’re doing their bookkeeping.

“Entering network fees into a bookkeeping format was a nightmare, “ Thibaut explained, “I could easily spend 2 hours on this alone. We were advancing network fees from other internal wallets, and I had to go to etherscan to extract and identify counterparties for every transaction processed. Some counterparties were users, others were smart contracts- they all had long pseudonymous ETH addresses. I would then have to add these addresses to an excel spreadsheet alongside our other company transactions.”

This pain point was one of our motivations behind launching our GSN fee-less accounts where network fees are covered by Multis. Because Multis is a banking app, our job is to remove all non-financial data. The fee-less accounts allow our users to report their business transactions,not internal transactions that cover network fees.

Multisignature access controls save your accountant time

One of the advantages of our multisignature wallet is that owners can invite users by email, and give them reading rights only. This means your company accountant can login to your account, consult funds, and even download a .csv file of your company’s transaction historywithout the fear that she will make any transactions herself. This makes your company workflow smoother and saves time in transferring data to excel files.

Tags, .csv exports, and an address book: making data compatible with crypto accounting software

Although we’re not (yet!) integrated with an accounting software, Multis has features that are crypto accounting friendly including a tag function that allows users to label expenses by type (IT, payroll, client services, etc.); a built-in address book allowing users to save the names and descriptions of frequent counterparties; and finally all transactional data can be exported to .csv format for an easier integration with traditional or crypto bookkeeping software.